doordash address for taxes phone number

Doordash address for taxes phone number Wednesday February 23 2022 Edit. If I wait longer than 10 minutes I typically send a quick note Still.

Doordash Driver Taxes 101 Dashers Guide Tfx

The Employer Identification Number EIN for Doordash Inc.

. However you may now be wondering what the process is for filing DoorDash taxes in 2022 to ensure you cover any tax liability. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash. How much did you owe in taxes DoorDash.

An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. Paper Copy through Mail. Up to 12 cash back Breakfast lunch dinner and more delivered safely to your door.

Hi Im Dash your DoorDash driver. There are no tax deductions or any of that to make it complicated. DoorDash will send you tax form 1099.

Heres the official mailing address for DoorDash headquarters. Now offering pickup no-contact delivery. While on the DoorDash support page you can choose to get.

Tax Forms to Use When Filing DoorDash Taxes. Here are some alternative ways to contact DoorDash customer service. 303 2nd St Suite 800.

EIN numbers are also referred to as FEIN or FTIN. Because DoorDash has offices all over the world they also have multiple support. Find EIN Contact Details for Doordash Inc.

DoorDash Headquarters Address. Pin By Tasha On P Oc Creative Gen Chipotle Mexican Grill Mexican Grill Day Pin On Gig Economy. If youd like to speak to a merchant sales representative you can contact us online or call us Monday-Friday.

901 Market Suite 600 San Francisco CA 94103. San Francisco CA 94107. Restaurants and more delivered to your door.

Already using DoorDash for Work. Doordash address for taxes phone number Tuesday March 15 2022 Edit. The forms are filed with the US.

It may take 2-3 weeks for your tax documents. United States and Canada. Its a straight 153 on every dollar you earn.

A 1099-NEC form summarizes Dashers earnings as independent. Internal Revenue Service IRS and if required state tax departments. Since DoorDash earnings are treated essentially the same.

DoorDash drivers are expected to file taxes each year like all independent contractors. No tiers or tax brackets.

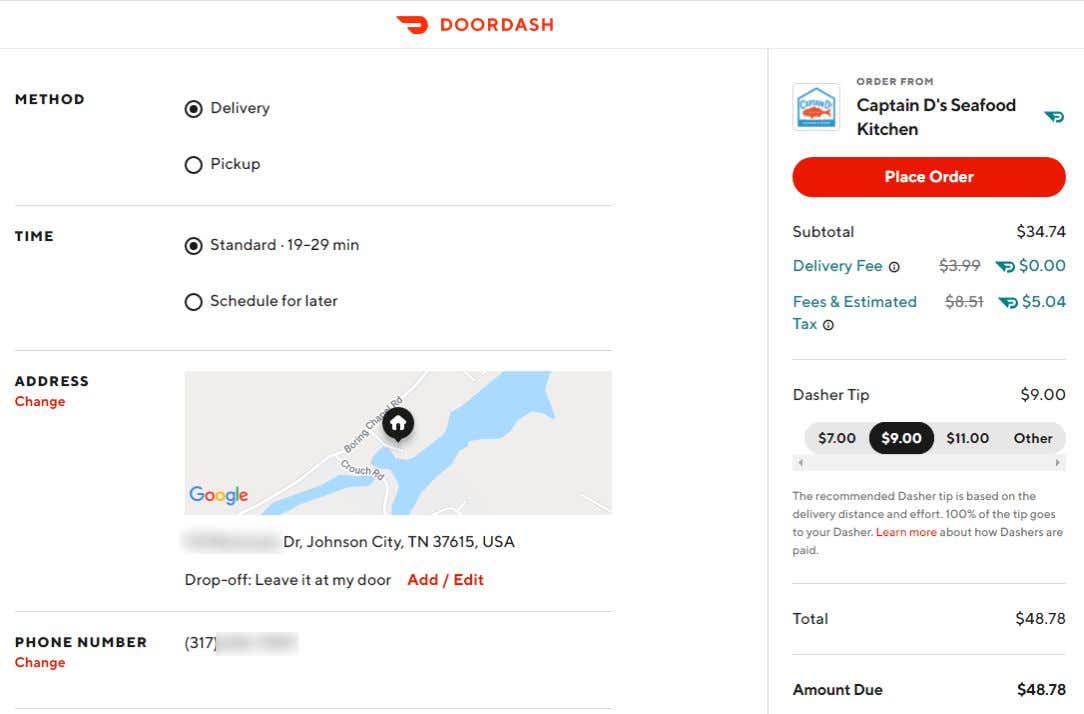

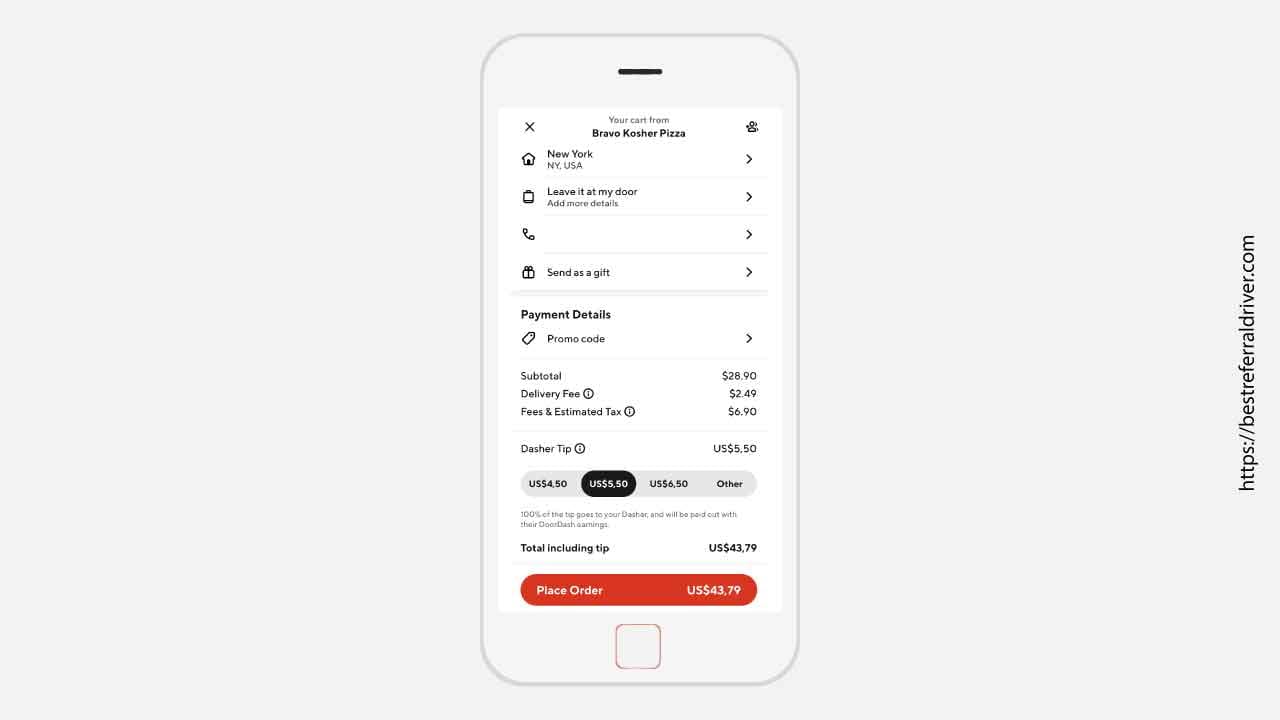

Doordash Fees How Much Does Doordash Cost In 2022

Doordash Tax Guide What Deductions Can Drivers Take Picnic Tax

Doordash Toll Free Number Doordash Customer Service

Doordash Taxes Schedule C Faqs For Dashers Courier Hacker

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier

How Much Do You Pay In Taxes Doordash Reddit Lifescienceglobal Com

Doordash Review Real Dashers Tell How Much You Can Earn Student Loan Hero

How To Get Doordash Tax 1099 Forms Youtube

Doordash Earnings Business Expands Growth Slows Freightwaves

Doordash Introduces Ultra Fast Grocery Delivery Providing Busy Consumers With A Reliable And Convenient Way To Restock Instantly

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How Do Food Delivery Couriers Pay Taxes Get It Back

How To Cancel A Doordash And Get Your Refund

Doordash Taxes Does Doordash Take Out Taxes How They Work

How Much Money Can You Make With Doordash Small Business Trends

How To File Doordash Taxes Doordash Drivers Write Offs

How Can I Contact The Customer Or Dasher Through The Tablet